iEdge S-Reit Index Weekly Review 1 Apr 24

Hello, everyone! Happy April Fool’s Day! 🎉 I hope you’re all having a wonderful day full of smiles and good surprises. I had a rough patch with a terrible migraine yesterday, but thankfully, I’m back on my feet today, ready to dive into our beloved SREITs!

Singapore Real Estate Investment Trust (S-REIT) Sector Developments for the week

In the latest SGX REITs & Property Trusts Chartbook, the average dividend yield for all 41 trusts is reported to be 7.3%, which may seem appealing at first glance. However, it’s crucial to look beyond the surface when evaluating these opportunities. The market’s efficiency often means that if an investment appears too good to be true, it could be carrying hidden risks. High dividend yields can sometimes indicate underlying issues with the trust, such as financial instability or a challenging market environment.

Moreover, with the total market capitalization standing at S$91 billion and the average gearing ratio—indicating the level of debt compared to equity—reported at 38.7% from the latest quarterly filings, it’s important to consider the financial leverage and potential risk exposure of these trusts. A gearing ratio close to 40% can suggest a moderate to high level of debt, which, while not necessarily negative, requires careful consideration in the context of overall investment strategy.

The Business Times reported that institutional investors sold off more than $560 million worth of investments in the first quarter of 2024, while retail investors went in the opposite direction, purchasing over $480 million. This divergence is not unexpected. Institutional investors often adjust their portfolios to account for long-term trends, such as the current ‘higher for longer’ interest rate environment. This suggests they are taking a cautious approach, anticipating that interest rates will remain elevated for an extended period, which can affect the value of their investments.

US Economic Data

The Personal Consumption Expenditures (PCE) index which measures inflation in consumer goods and services came in at 0.3%, meeting expectations. US Federal Chair Powell commented on Friday that inflation data was in line with expectations. He said that while the central bank was not in a hurry to cut rates, it was good to see the data as per expected.

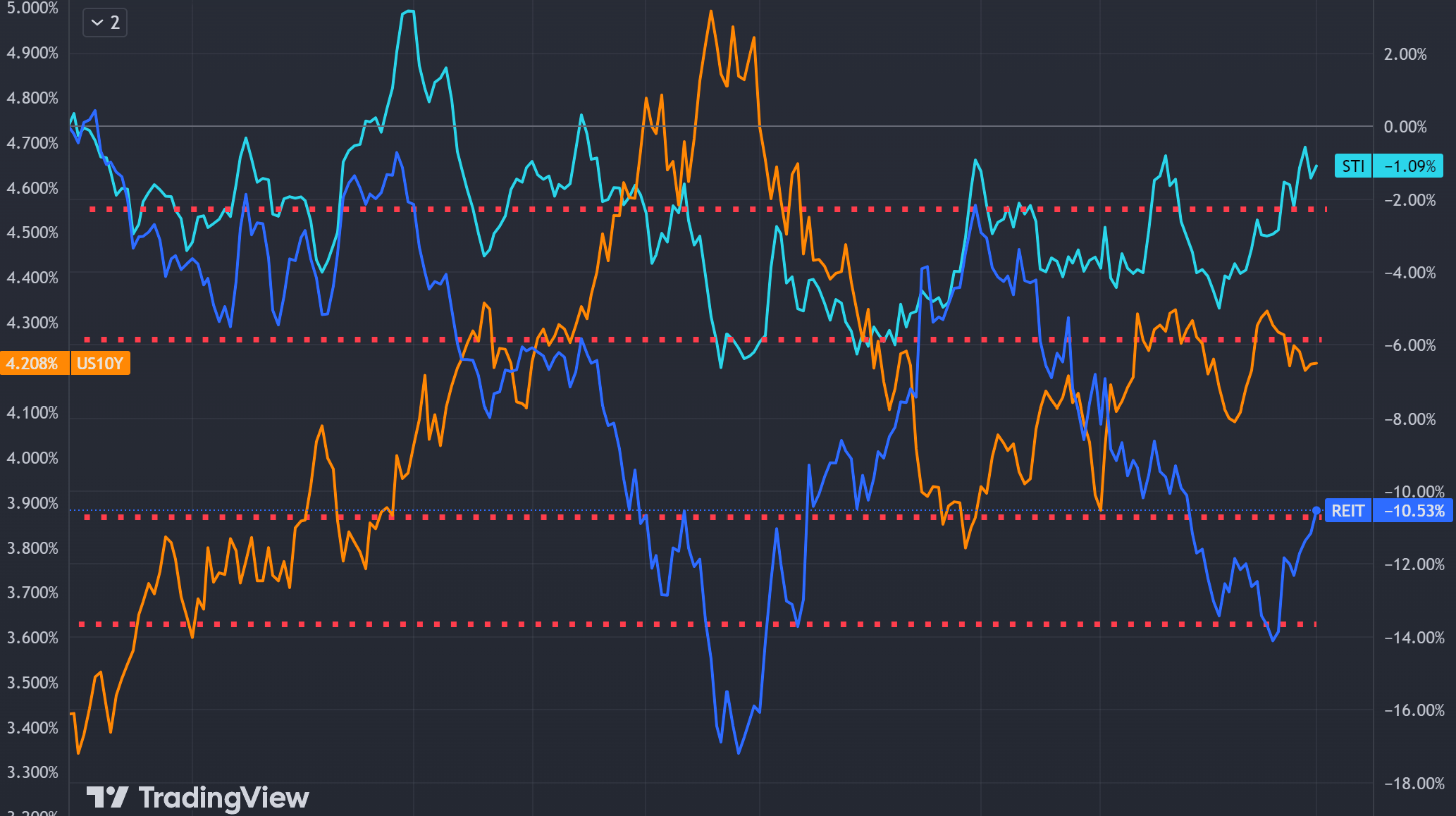

The chart above continues to illustrate the ongoing inverse correlation between the iEdge S-Reit Index (in blue) and the US 10-Year Treasury Bond Yield (in orange). Specifically, it shows that when the US 10-Year Treasury Bond Yield decreases, the iEdge S-Reit Index tends to rise.

The yield on the US 10-Year Treasury Bond has stayed below 4.3%, recently dropping closer to 4.2%. This suggests that investors do not expect recent economic developments to prompt the US Federal Reserve to delay or increase interest rates. As a result, we see the iEdge S-Reit Index continue its recent recovery from its low point. This upward movement is now testing a resistance region. Essentially, investors seem cautiously optimistic, reflected in these movements.

The week ahead brings us a number of important US economic data releases, which include:

ISM Manufacturing PMI / ISM Services PMI – Purchasing Managers’ Index is a survey of purchasing managers and is important as the sentiment of purchasing managers is a leading indicator of economic health. A healthy sentiment suggests that an economy is moving along well, while a cautious sentiment may see fewer business activities because of prudence.

Speech by Fed Chair Powell which may include comments regarding the current inflation and interest rate situation, potentially affecting market sentiments

Unemployment Claims – Reports the number of individuals filing for government assistance due to job loss, seeking new employment. This figure is a critical indicator of the number of people currently unemployed and seeking support, reflecting the job market’s health and, by extension, the overall economy.

ADP Non-Farm Employment Change / Average Hourly Earnings m/m / Non-Farm Employment Change – Together, these indicators are crucial for understanding the current state of employment, wage trends, and overall economic momentum in the US. They influence Federal Reserve policies, investor sentiment, and can significantly impact financial markets. A positive outlook in these reports often suggests economic expansion, while negative data may indicate slowing economic activity.

These US economic data and events contribute to the overall picture of the US economy’s health and guides the US Federal Reserve‘s interest rate policy. It is crucial to stay informed about these developments, as the SREITs sector is highly dependent on interest rate trends for cost management, which affects profits and distributions.

I cannot stress enough the importance of being selective with SREITs investments. Look for those demonstrating prudent cost management and active revitalization of their portfolios as key indicators of potential success.

I invest in the CSOP iEdge SREIT ETF on a weekly basis. This approach allows me to maintain exposure and diversification within the SREITs sector, while also averaging down my overall investment cost.

The dividend scrip units for CapLand IntCom T have been credited and are now reflected in my holdings and trading details. Please find the links below.

Found this article useful? Share it and let us all have free coffee from dividends!