iEdge S-Reit Index Weekly Review 15 Dec 23

Good day!

Most Singapore REITs received a huge boost towards the upside, bringing a number of them to recent highs as the week draws to a close.

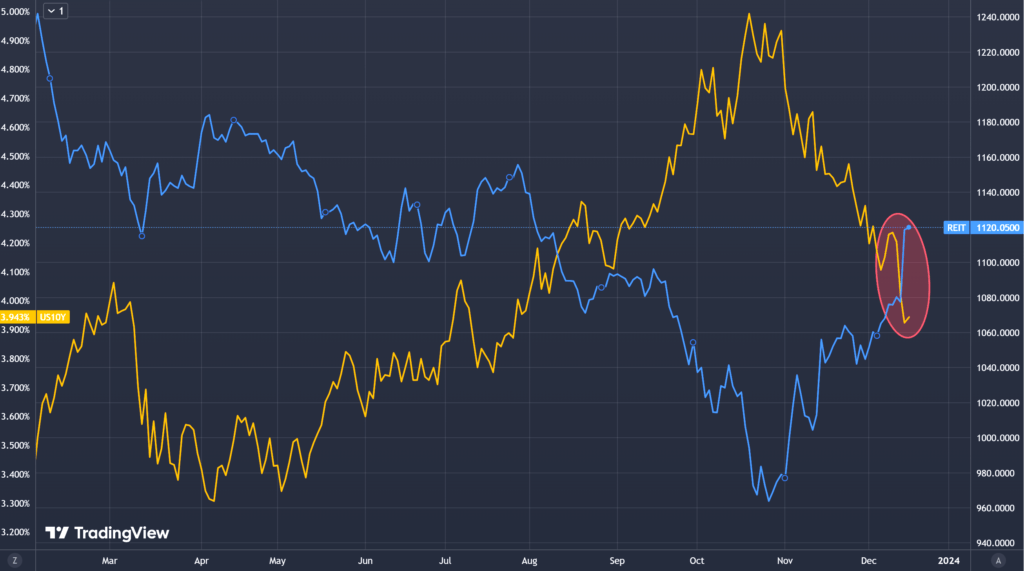

In the previous week, we examined the inverse correlation between the US 10-Year Treasury Bond Yield and the iEdge S-Reit Index so as to try to understand better what is happening.

In the chart above, the US 10-Year Treasury Bond yield (yellow) has dipped sharply due to the dovish interpretation of the recent US Federal Open Market Committee (FOMC) statement and conference on 13 December 2023.

While the FOMC decided to leave interest rates unchanged at a range of 5.25% to 5.50% which was anticipated by Wall Street, the Fed acknowledged that economic growth had slowed and inflation had eased over the past year, signaling a shift in their policy approach. This decision marked the third consecutive meeting without a rate hike.

REITs are sensitive to interest rates because they often rely on borrowing to finance property acquisitions and developments. Lower interest rates mean lower borrowing costs, improving profit margins. When interest rates drop, the cost of new loans or the refinancing of existing debt becomes less expensive, directly aiding their bottom line.

Hence, the iEdge S-Reit Index (blue) which is regarded as Singapore’s S-REIT Benchmark spiked correspondingly. Where do we go from here will depend on the coming weeks and months.

If the US economic data continues to show easing, the US Federal Reserve may consider loosening the current interest rate regime.

On the flip-side, as cautioned by Fed Chair Jerome Powell, inflation is still high and the path forward is uncertain. The US Feds remain ready to tighten conditions if needed.

In my opinion, the current spike in prices is probably a result of sentiments rather than changes to the fundamentals. If we recall, interest rate cuts took time to filter down to the economy and likewise for any reversal. There are loans that remain to be paid by S-REITs at the current high rates. A number of them who do not qualify for the increased regulatory gearing limit of 50% are near to the base rate of 45%. This means that the amount of debt is close to 45% of the total asset value.

As I wait for a correction to buy in at a more attractive price, I am doing regular purchases of the CSOP iEdge S-REIT Leaders Index ETF. This is a basket of the most liquid S-REITs and gives me a wide exposure across the market segment. Due to the Dollar Cost Averaging regime, the impact of buying at too high a price is mitigated. I will be updating the portfolio page with that holding soon.

Did you catch the upside surprise? Enjoy your weekend and I will see you next week!

(BTW subscribe for free updates la. See below :P)