iEdge S-Reit Index Weekly Review 19 Feb 24

Good day everyone. Hope you are well!

We have been seeing some choppy-ness in the SREITs sector lately but it is not unexpected. More on that later. Let’s take a look at the recent developments.

Singapore Real Estate Investment Trust (S-REIT) Sector Developments for the week

It has been reported that despite the recent volatility, retail investors are actively engaged in the SREITs scene. A total net purchase of over $280 million has been recorded so far this year.

These are the top 10 S-REITs and the net amount inflow:

- Mapletree Logistics Trust: S$62.3M

- Keppel DC REIT: S$49.7M

- CapitaLand Ascendas REIT: S$42.2M

- Mapletree Pan Asia Commercial Trust: S$20.0M

- CapitaLand China Trust: S$18.6M

- CapitaLand Ascott Trust: S$16.7M

- CapitaLand Integrated Commercial Trust: S$13.7M

- Frasers Logistics & Commercial Trust: S$11.1M

- CDL Hospitality Trusts: S$9.6M

- ParkwayLife REIT: S$6.4M

The Dividend Portfolio currently has assets in Mapletree Logistics Trust, Keppel DC REIT, CapitaLand Ascendas REIT, CapitaLand Integrated Commercial Trust, Frasers Logistics & Commercial Trust.

I am surprised that we do not see Frasers Centrepoint Trust in this list. I have observed that it is rather resilient, a testament to the evergreen nature of suburban mall serving their neighborhoods. Furthermore, its gearing level stands slightly below 40% which places it among the lower ones. A low level is good because it means the costs of borrowing is low and there is more buffer available to borrow if needed.

This brings me to another development which highlights the importance of prudent selection.

It was reported that Keppel Pacific Oak US REIT (KORE) has suspended its distributions for two years as part of a recapitalization plan aimed at raising capital for sustained investments. This decision comes in the wake of KORE’s distributable income for the second half of the year ended December 31, 2023, falling by 10.1% year-on-year to US$26.1 million. The suspension of dividends starts from the second half of 2023 and extends through to the end of the second half of 2025. This move led to a significant drop in the share price of KORE, close to 40%.

While SREITs are listed on SGX, we need to be mindful of the target region and sector.

Keppel Pacific Oak US REIT is a US focused office properties REIT and hence it faces two challenges. The higher for longer interest rates maintained by the US Federal Reserve which significantly increased borrowing costs and the structural change in work dynamics such as hybrid work models. (incorporating remote work) This translates to a downside pressure on office space demand.

Therefore as always, I continue to stress the need for us to seek out SREITs that are positioned in favorable sectors/themes and are actively managing their portfolios and financial health.

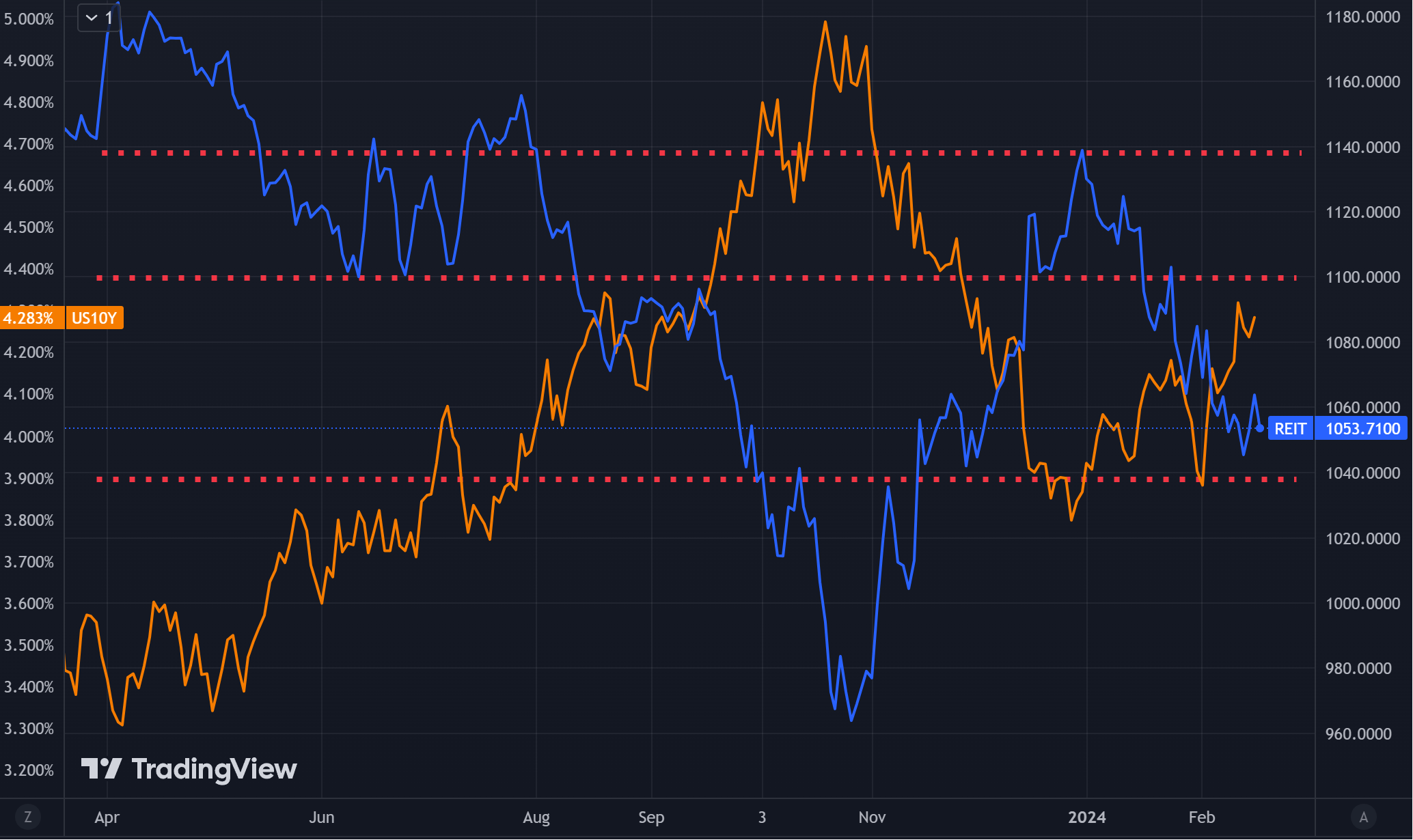

SREIT Index Blue US 10 YR Treasury Yellow

In the chart above, we see that the inverse correlation between the iEdge S-Reit Index (blue) and US 10-Year Treasury Bond Yield (orange) remains. This means that when the US 10-Year Treasury Bond Yield goes up, iEdge S-Reit Index usually goes down.

For those of you who are new, when the yield of the US 10-Year Treasury Bond goes up, it presents a more attractive/less risky alternative to other market offerings such as SREITs. On the flip side, if it goes low, investors are driven to seek better returns such as the regular dividends from SREITs. Furthermore, a higher US 10-Year Treasury Bond yield usually means interest rates are high which translate to high borrowing costs, adding another layer of pressure.

We observe that the iEdge S-Reit Index remains weaken as the US 10-Year Treasury Bond Yield continues to climb. The annual inflation rate in the United States for the 12 months ending in January 2024 was reported at 3.1%, a slight decrease from the 3.4% rate observed in December 2023. This decrease is lesser than expected and has prompted the market to further reduce their expectations of interest rate cuts for 2024. Economics were mostly expecting to see 2.9%.

This translates to the anticipation of challenging conditions for the REITs sector and hence prices remain pressured. The index continues towards the next support level.

I have added to CapitaLand Integrated Commercial Trust when it dipped on the ex-dividend date. You can see the transaction in my trading history by clicking the link at the bottom.

The ex-dividend date is the cut-off day set by a stock to determine which shareholders are eligible to receive a declared dividend. If you buy a stock on or after this date, you won’t receive the upcoming dividend payment. Instead, the dividend will go to the seller.

While I will not get the dividend for the latest distribution, I am actually locking in a better price which is prudent for a long-term view. As mentioned last week, CapitaLand Integrated Commercial Trust impresses me with their portfolio renewal efforts. Junction 8 is much bigger now and commands a huge crowd. Funan Mall is unique and offers a fresh experience with its steps for chilling out, rock climbing and even a bicycle track passing through it. Clarke Quay is a popular destination for locals and tourists for lifestyle and dining experiences and is also undergoing asset enhancement works. This REIT is one of the rare gem to have increased their DPU this year.

I also received a dividend of $1056.76 from Keppel Infrastructure Trust. This brings the total dividend to be 23% of my cost and I am grateful for all the free coffees it brought me 😛 While it is technically not a REIT, because of the nature of its objectives, I consider it and my other non-REIT asset of NetLink Trust to be main pillars of the Dividend Portfolio.

As usual, I continue to invest into CSOP iEdge SREIT ETF weekly to maintain exposure to the market. You can also view my latest transactions and portfolio in the links below.

Found this article useful? Share it and let us all have free coffee from dividends!