iEdge S-Reit Index Weekly Review 20 May 24

Hello dear readers!

How have you been for the last two weeks? Hope you are seeing greens with your investment journey.

In my last review, I mentioned that I had trimmed some of my REITs portfolio for a capital gain profit as I adjusted to the ongoing challenge faced by the sector. Having said so, SREITs remains a cornerstone of my free coffee from dividend plan as they are very dividend focused.

Looking at the chart above we see the inverse correlation between the iEdge S-Reit Index (in blue) and the US 10-Year Treasury Bond Yield (in orange). At the moment, the US 10-Year Treasury Bond Yield has bounced off a support while the iEdge S-Reit Index is in the midst of testing one.

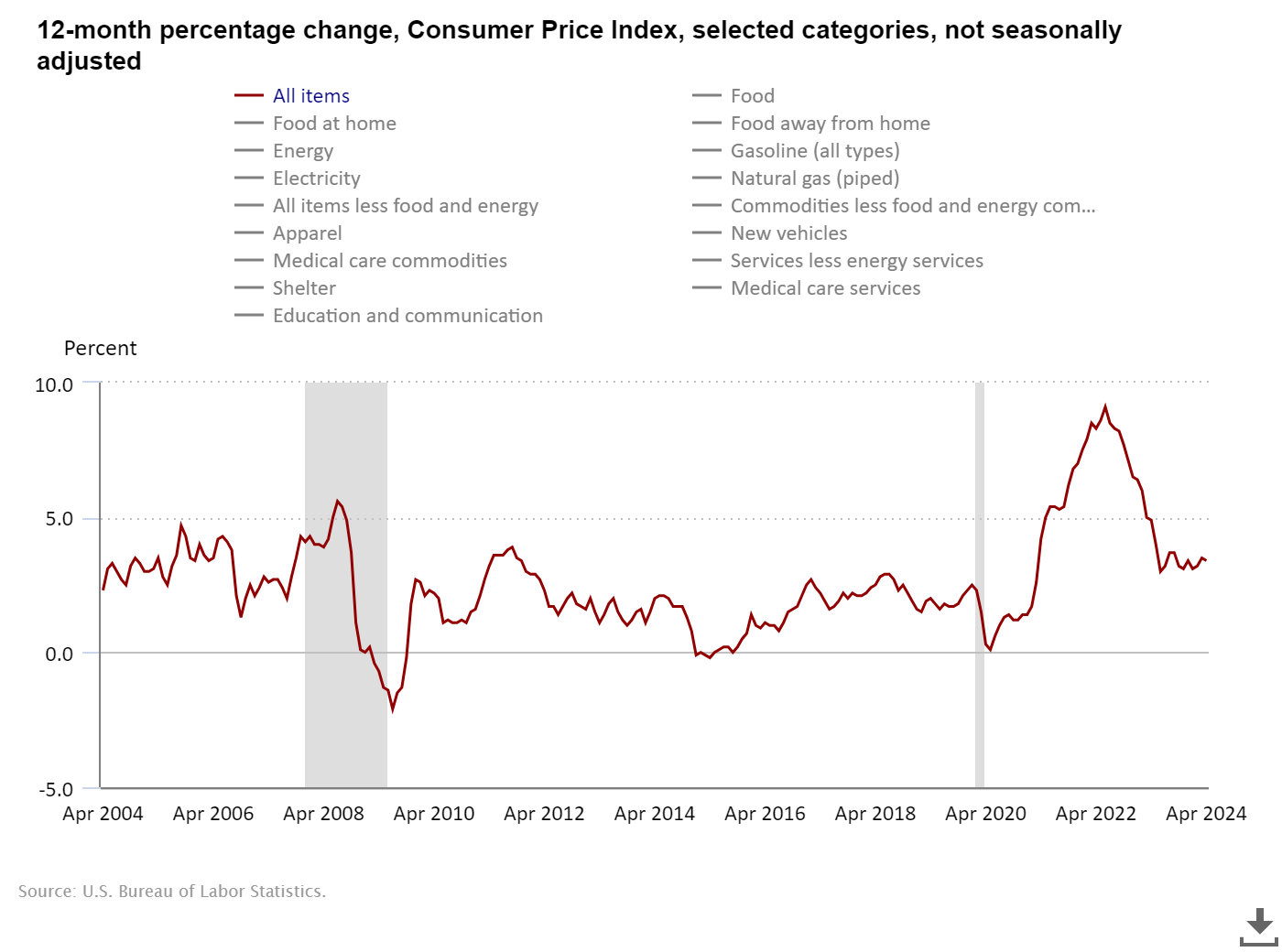

Price action largely remained sentimental in nature. This is especially seen after the weaker than expected US Consumer Price Index, which is a barometer of inflation. Investors saw this as a possibility that interest rate cuts might come sooner and hence the uplift in the SREITs sector. I find this particularly challenging as it is highly unpredictable how the market reacts. For example, a weaker US Jobs Data sparking positive sentiments instead of aversion because of bets on interest rate cuts.

We also see that the STI index is doing better as it represents various sectors including those that are less prone to inflation and hence less vulnerable to the corresponding shift in sentiments.

Now let us cut through the noise and look at the US official Consumer Price Index chart. We see that it has still some space to drop before reaching the 2% desired by the US Federal Reserve. This means that any uplift seen can easily be reversed as the sector remains hostage to sentiments. Remember the speculation of soon to come interest rates cut at the start of 2024? We are almost halfway through the year and still not seeing one in sight.

In the meantime we must remind ourselves not to be enticed by high yields as often it comes with excessive risk. For example, a REIT that suffered a big drop in price will see its dividend yield jump up as it is a lagging indicator. I personally go for SREITs with prudent capital management and active renewal activities.

As mentioned last time, I now prefer to buy through an ETF instead, which is the CSOP iEdge SREIT ETF. This strategy allows me to maintain exposure and diversification within the SREITs sector, while also reducing my overall investment cost through dollar-cost averaging.

I find this approach particularly useful now, given the bearish sentiment, as selecting individual trusts may expose me to the risk of unexpected downside events.

Remember, the trend is your friend and right now I do not see any obvious signs of a turnaround.

Found this article useful? Share it and let us all have free coffee from dividends!