iEdge S-Reit Index Weekly Review 25 Dec 23

Merry Xmas everyone!

The past week saw S-REITs continue to receive upside pressure. Having said so, we are starting to see some indication of consolidation.

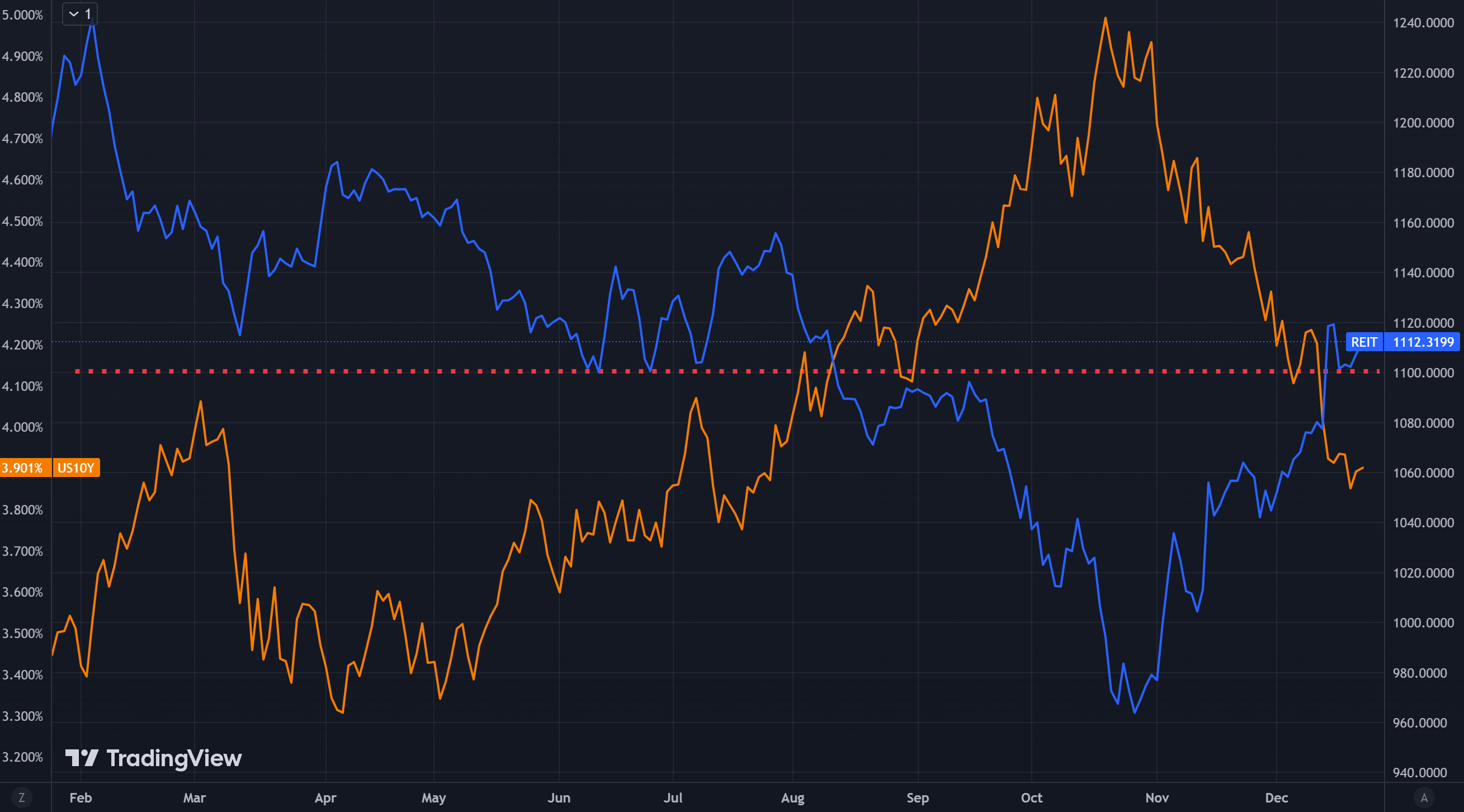

Continuing on from the previous week, lets examine the inverse correlation between the US 10-Year Treasury Bond Yield and the iEdge S-Reit Index so as to try to understand better what is happening.

In the chart above, we can see the US 10-Year Treasury Bond yield (yellow) continued its retreat from the previous high. This is due to the dovish interpretation of the recent US Federal Open Market Committee (FOMC) statement and conference on 13 December 2023.

As we move into the new year, the market will likely shift focus towards how interest rates will be cut. This expectation versus what actually happens may guide how much upside pressure will continue for S-REITs.

Referring to the red dotted line, S-REITs are at a major support and resistance level. It will be prudent to observe how the price action reacts in the coming weeks.

Active Capital Management in S-REITs

As we delve deeper into the performance and strategies of S-REITs, it’s crucial to note the recent proactive measures taken by some trusts to fortify their financial standings amid a challenging economic landscape. Over the past week, notable actions include raising equity, reducing debt, and asset divestments, signaling a keen focus on robust capital management.

Gearing Levels and Investor Sentiment

With higher interest rates impacting valuations, S-Reits are strategically managing their gearing levels, which regulatory requirements cap between 45 to 50 percent, depending on their interest coverage ratio. However, many aim to maintain gearing below the 40 percent psychological barrier preferred by investors. This cautious approach is evident in the recent maneuvers by several trusts:

Elite Commercial Reit announced a fully underwritten preferential offering to reduce its gearing significantly. This move not only strengthens its balance sheet but also increases its market capitalization and debt headroom, indicating a forward-thinking approach to financial health and investor confidence.

Cromwell European Real Estate Investment Trust engaged in a strategic bond buyback, reducing refinancing risks and mitigating the impact of rising interest rates. This proactive step underscores the importance of adjusting debt strategies to navigate uncertain economic waters effectively.

Strategic Divestments and Portfolio Optimization

Asset divestments have been a key strategy for S-Reits looking to optimize their portfolios and improve returns:

CapitaLand Ascendas Reit announced the divestment of three Australian properties at a premium, reflecting a keen eye for timing and market conditions. This move aligns with its strategy to enhance portfolio quality and optimize returns for unitholders while slightly reducing aggregate leverage.

CapitaLand Ascott Trust is divesting three hotels in Japan above book value, a move that will unlock value and allow for capital redeployment into higher-yield assets. This strategy demonstrates a dynamic approach to portfolio management and capital allocation.

IReit Global‘s divestment of a property in Spain at a premium further exemplifies the trend of S-Reits leveraging asset sales to reduce debt and explore growth opportunities. The move is expected to lower the aggregate leverage, providing more financial flexibility.

Looking Ahead

As S-REITs continue to navigate the interplay between interest rates and market dynamics, the end of 2023 has seen a concentrated effort to strengthen financial positions and prepare for the future. The actions taken by these REITs, from gearing adjustments to strategic divestments, reflect a broader industry trend towards capital conservation and strategic asset management in anticipation of a potentially volatile market in 2024.

I will be looking out for such developments, as they may significantly influence the performance and stability of S-REITs in the coming year. Not all S-REITs are made the same. Focusing on quality ones may bring more value to our investments.