iEdge S-Reit Index Weekly Review 26 Feb 24

Good day everyone. I am feeling a little unwell. Arrghh. I hate it because it means I can’t look at the markets as much as I like. But this weekly review is a commitment so here I am! (Unless if I faint or what la, then no choice. LOL)

Singapore Real Estate Investment Trust (S-REIT) Sector Developments for the week

The Business Times’ REIT Watch mentioned that healthcare related assets are among the most resilient commercial real estate sectors. First Reit and ParkwayLife Reit outperformed the iEdge S-Reit Index with a 8% and 2% gain respectively for the month till 22 Feb. The index fell 0.7%.

I previously had First Reit on the Dividend Portfolio, before its value was heavily diluted, prompting me to switch out. I am not sure if I am ready to jump back in, but the resilience of healthcare does make sense considering its essential nature. I think it will also depend on how well the REIT is run because I believe no amount of tailwind can mitigate management issues.

In the latest SGX Group Chartbook for REITs, it was reported that the FTSE ST REIT Index 10-year total return is 80.1% with an average dividend yield of 7%. On the other hand, the 10-year total return for SP500 as of Jan 2024 is 171.8%.

I want to use this opportunity to highlight the fact that REITs are more for long-term regular income from dividends with possibly some capital appreciation. It is unlikely to see the great price momentum of growth stocks unless when there are extraordinary factors such as a boom in the sector itself.

Another interesting fact is about Keppel DC REIT, a core component in the Dividend Portfolio. In the month of January 24, it holds the top spot for Retail Net Buy at 47.5 million and Institution Net Sell at -57.3 million. I am aware of the common perception of smart money (institutions) vs dumb money (retail aka me :P) but I really hope this will be a win. Data Centres are critical to technology, riding on a huge tailwind.(Look at the magnificent 7 of US Stocks)

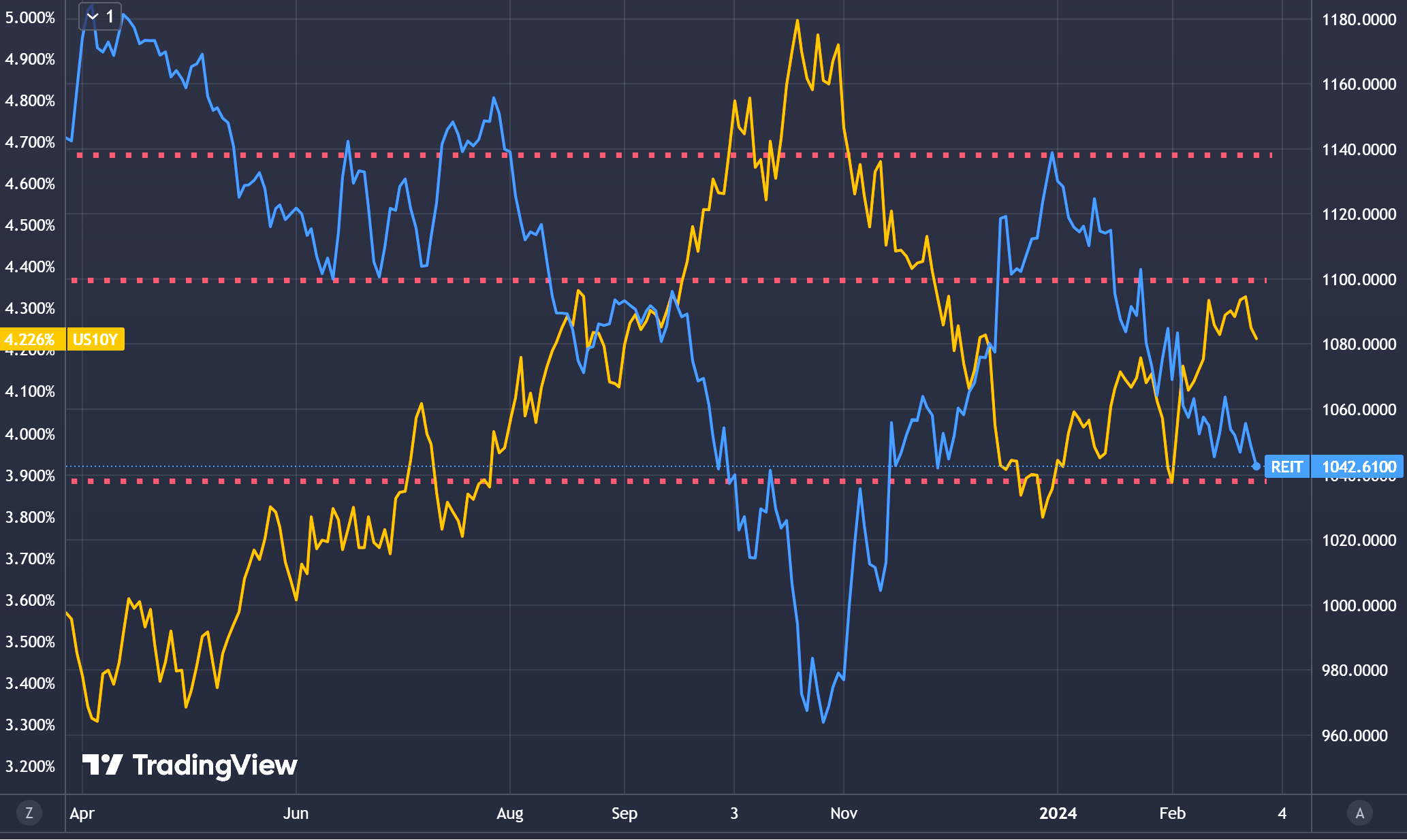

In the chart above, we see that the inverse correlation between the iEdge S-Reit Index (blue) and US 10-Year Treasury Bond Yield (orange) generally remains. This means that when the US 10-Year Treasury Bond Yield goes up, iEdge S-Reit Index usually goes down.

While the US 10-Year Treasury Bond has retreated after hitting our resistance region, we have yet to see a corresponding climb for the iEdge S-Reit Index which is also testing our support region. If the correlation continues, we should expect to see some relief for the SREITs soon. However, in view of a few important US economic statistics due to be released this week, such as the Preliminary GDP (Gross Domestic Product) and Core PCE Price Index (Personal Consumption Expenditures), price movement may be muted as investors await clues of the current US Inflation situation.

If the support level for the iEdge S-Reit Index breaks, especially with a corresponding surge of the US 10-Year Treasury Bond above the resistance, we may see SREITs heading back towards their lows from late 2023.

I recently read an article from FSM (fundsupermart) about Keppel Infrastructure Trust. It is a cautionary post regarding the higher for longer interest rate environment which may lead to financial challenges that requires equity fundraising or a reduction in distributions. Their 2026 target price is 0.52, which is rather limited. It is trading at 0.495 today. They recommend investors to consider trimming their positions.

It is a tough pill to shallow, and I am leaning towards just hunkering down. Having said so, I have seen the downside of not being nimble. (I previously had 100k in a popular unit trust that went into a multi year down trend. Took me quite a while to finally cut it. It could have been a less painful lesson 🙁 but I was stubborn.)

In view of this, I will (reluctantly :P) keep a lookout for good opportunities that may be candidates for my trimming of Keppel Infrastructure Trust which is currently 21% of my Dividend Portfolio. Of course this does not mean that the article by FSM or anyone for that matter to be a guarantee. I am just keeping my opinions open in view of new information.

I continue to invest into CSOP iEdge SREIT ETF weekly to maintain exposure to the market and I have received the first dividend from it! $66.70 which is over 2% of my cost. You can also view my latest transactions and portfolio in the links below.

Found this article useful? Share it and let us all have free coffee from dividends!