iEdge S-Reit Index Weekly Review 31 Dec 23

Time flies and in a few hours it will be the New Year for me!

How was your 2023 investment journey? Did you manage to get lots of coffee from the dividends?

Uncle me cannot complain. Blessed and grateful for all the progress made in growing my dividend portfolio.

The past week still saw S-REITs continue to receive upside pressure. This is probably fueled by sentiments and not fundamentals. For example, the Santa Clause Rally effect.

So what causes the Santa Clause Rally? No one knows for sure! But generally:

- Holiday Optimism: The general optimism of the holiday season might contribute to a more positive market sentiment.

- Institutional Investments: Large investors, like mutual funds, might be rebalancing portfolios before the year ends.

- Bonuses and Investments: Some people invest their year-end bonuses during this time, which can increase buying pressure on stocks.

- Window dressing: Fund managers may want to improve the appearance of a portfolio or fund’s performance before presenting it to clients or shareholders, especially at the end of a quarter or year by purchasing high-performing stocks

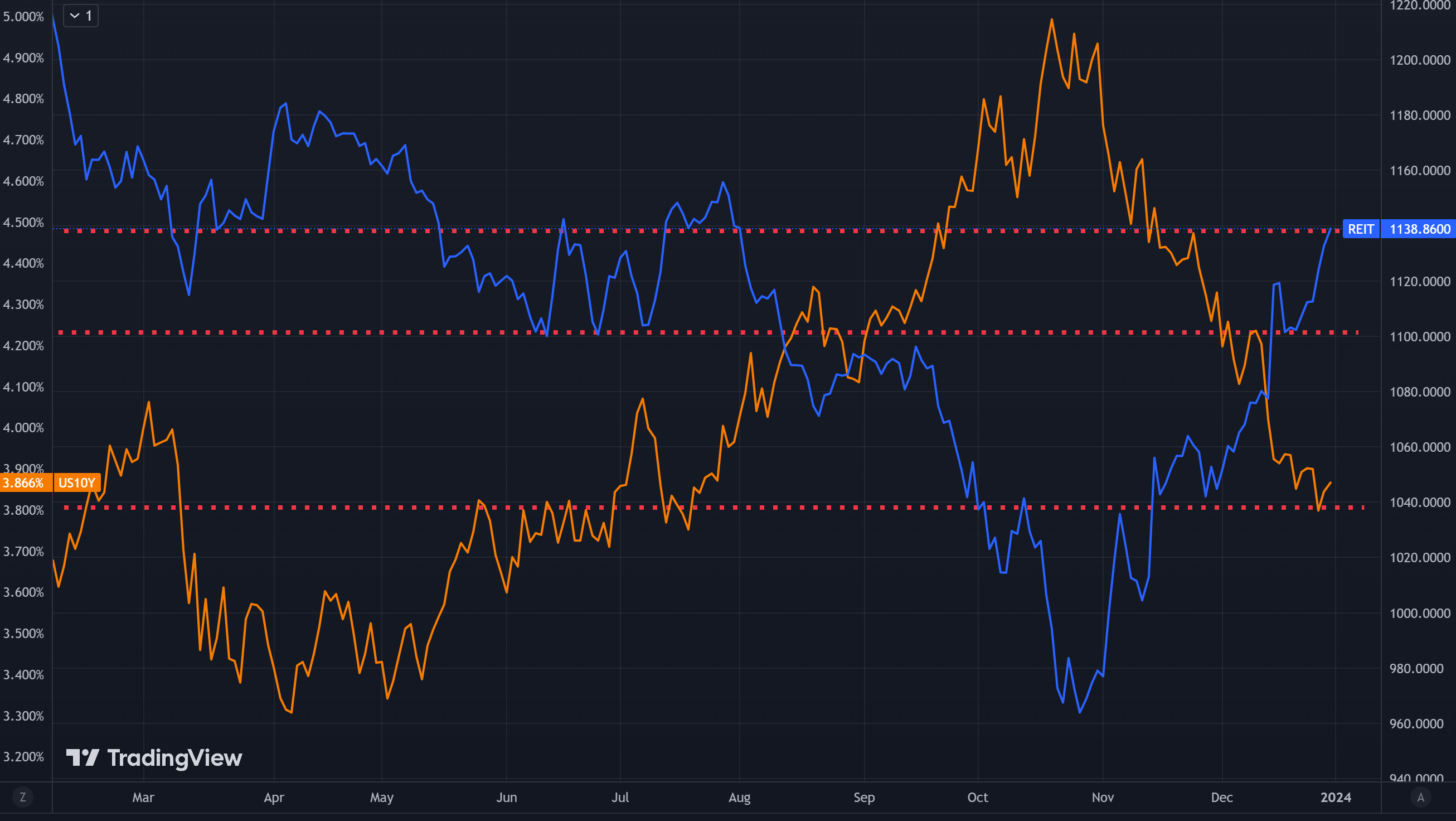

In the chart above, we can see that the inverse correlation between the US 10-Year Treasury Bond Yield (orange) and the iEdge S-Reit Index (blue) remains. This means that when the US 10-Year Treasury Bond Yield goes down, iEdge S-Reit Index usually goes up.

I also plotted 2 more dotted red lines to bring attention to the possible support and resistance regions based on historical price action. While there is no guarantee that the price action will react the same, at least we can be mindful of the possibility.

As we move into the new year, the market will probably shift focus towards how interest rates will be cut. This expectation versus what actually happens may guide how much upside pressure will continue for S-REITs.

Economic conditions will remain tight since no interest rate cut has actually happened. Hence it is still business as usual for S-REITs. Debts will be due and refinancing must be done. We need to watch for gearing (the ratio of a REIT’s debt to its total assets or equity) levels. If it is too high, there will be less room for manoeuvring in the event of market condition worsening.

I continue to lean towards prudence and caution.

I prefer S-REITs with lower gearing levels and active debt reduction measures. For example, CapitaLand Ascendas REIT and Mapletree Industrial Trust are both below 40%.

While waiting for a pullback, I continue to invest into CSOP iEdge SREIT ETF weekly so as to maintain exposure to the market.