iEdge S-Reit Index Weekly Review 5 Feb 24

Good day everyone. Hope you had a great weekend.

Today is a sea of red again. I wonder if this is starting to be a trend, where stocks are usually dumped on Mondays. But of course I would see this as an indication of how depressed sentiments are for the sectors we are keen in, such as SREITs.

Let us take a look at some recent developments for SREITs.

Singapore Real Estate Investment Trust (S-REIT) Sector Developments for the week

S-REITs experienced a drop in performance after recording one of their best months ever with a 9% rally in December 2023, extending from a near 7% gain recorded in November 2023. The iEdge S-REIT index fell by 5.1% from 1138 points to 1080 points in January 2024.

This decline in January 2024 is not unexpected. If you have been following the blog, I mentioned that interest rate expectations remain at risk of being overly optimistic. The enduring strong US economy gives little reason for the US Feds to rush into easing rates as a premature loosening of monetary policy may risk a comeback of inflation.

A theme that I have not really touched on would be the stronger SGD. This is especially crucial to SREITs with overseas assets as the income when converted back would be worth lesser. This leads to a drop in valuations and income generation potential, adding downside pressure when investors see it in the result presentations.

- CapitaLand Ascendas REIT – Distribution Income has dropped by 1.4% for FY2023 vs FY2022, mainly because of an increase in borrowing costs. Distribution Per Unit also declined by 4% in the same period because of the lower distribution income and a larger unit base from a private placement in May 2023 and issuance of units for the partial payment of Base Management Fees in June and December 2023. While gearing has increased from 36.7% in Jun 2023 to 37.9% in Dec 2023, it remains at a healthy level with headroom of about S$4.3b before reaching MAS’s aggregate leverage limit of 50.0%.

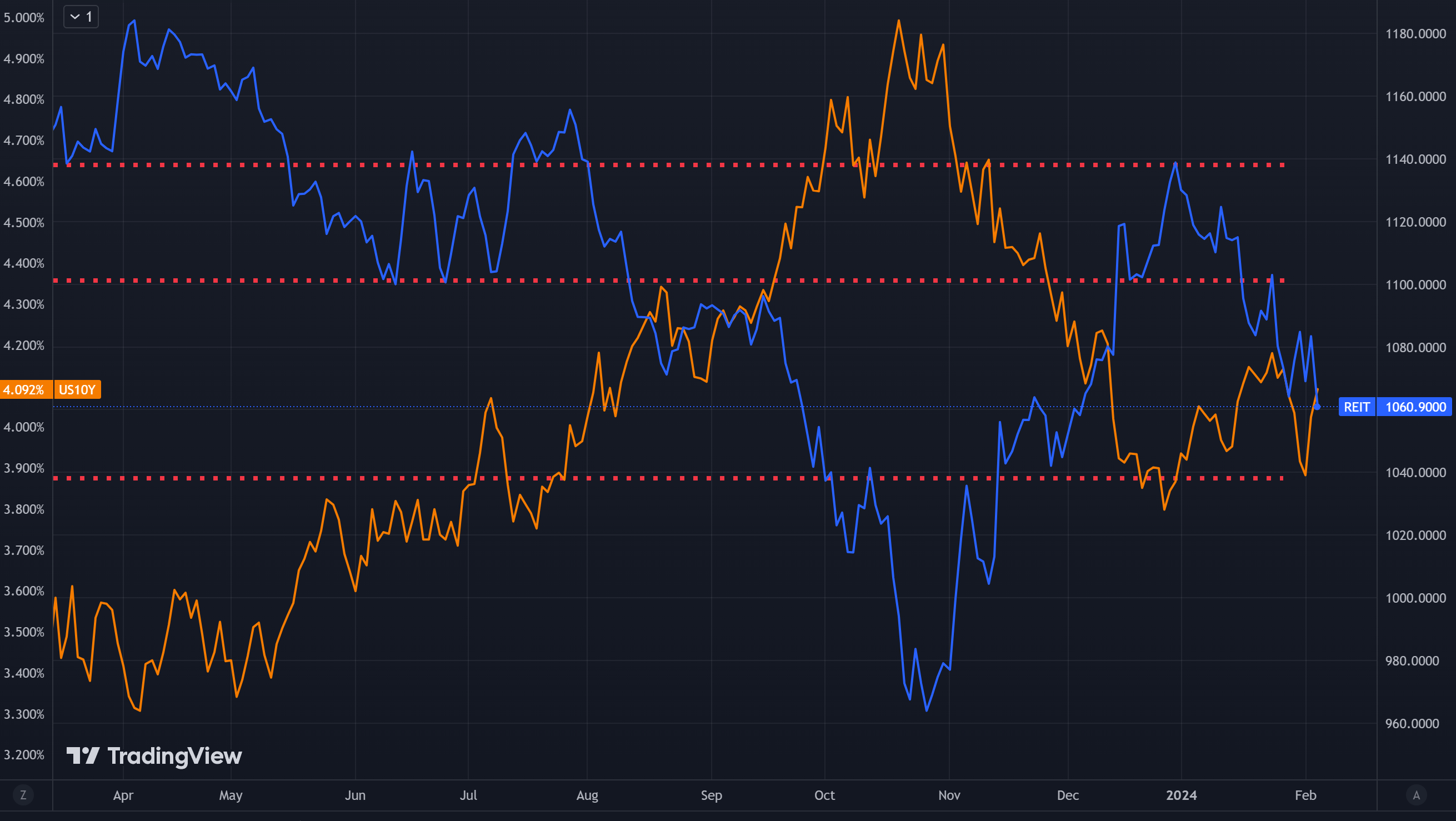

In the chart above, we can see that the inverse correlation between the iEdge S-Reit Index (blue) and US 10-Year Treasury Bond Yield (orange) remains. This means that when the US 10-Year Treasury Bond Yield goes up, iEdge S-Reit Index usually goes down.

The iEdge S-Reit Index has weaken further as the US 10-Year Treasury Bond Yield climbs back above 4% after failing briefly below. There was no indication of an imminent interest rate cut in the US Feds latest policy statement. It revealed that a greater confidence that inflation is moving sustainably towards the 2 per cent target must be seen before cuts are appropriate.

Market participants probably adjusted their interest rate cut bets to reflect the higher for longer conditions. This can be seen in the REITs sector as many prices were depressed. The index continues towards the next support level.

Today I would like to share a tale of caution. You know I am rather bullish about the performance of data centers. Maybe my self proclaimed title of a Tech Nerd contributes to my bias! I started acquiring Keppel DC Reit at 1.84, added more at 1.76 and 1.7.

And today, I added a little more at 1.63, making it the second largest asset in my Dividend Portfolio at 18%! This brings my cost price to around 1.75.

While I continue to believe in the theme of data centers being the lifeblood of technology, I am a little uncomfortable for it to be my second largest holding. All in the name of portfolio diversification. Becoming too big makes it more like a bet. In hindsight, I could have waited longer between purchases and probably gotten better prices!

I would like to see more retail SREITs such as Frasers Centrepoint Trust or perhaps a hospitality focused SREIT which is lacking in my Dividend portfolio for now.

So here you go, honesty and transparency for all! Hope you will learn something from my over enthusiasm. I guess I am human after all!

One thing I am proud of is my resilience towards extra high dividend yield stocks! I would like to caution again dear readers to not be hyper focused on dividend yields. A higher than normal dividend yield may be because of a big drop of stock price or reflection of a higher risk.

I continue to invest into CSOP iEdge SREIT ETF weekly so as to maintain exposure to the market. You can also view my latest transactions and portfolio in the links below.

Found this article useful? Share it and let us all have free coffee from dividends!