iEdge S-Reit Index Weekly Review 6 May 24

Hi dear readers!

I wanted to do this review differently, just focusing on my immediate thoughts about the SREITs sector.

In my opinion, the higher for longer interest rate situation in the US has trickled down all faucets of the economic markets. We do see a tightening monetary situation resulting in higher financing costs.

As the market reacts to the developments, we see a pattern of losses and rallies riding on the back of sentiments. This is important to understand as it means that any analysis will be affected by randomness (sentiments).

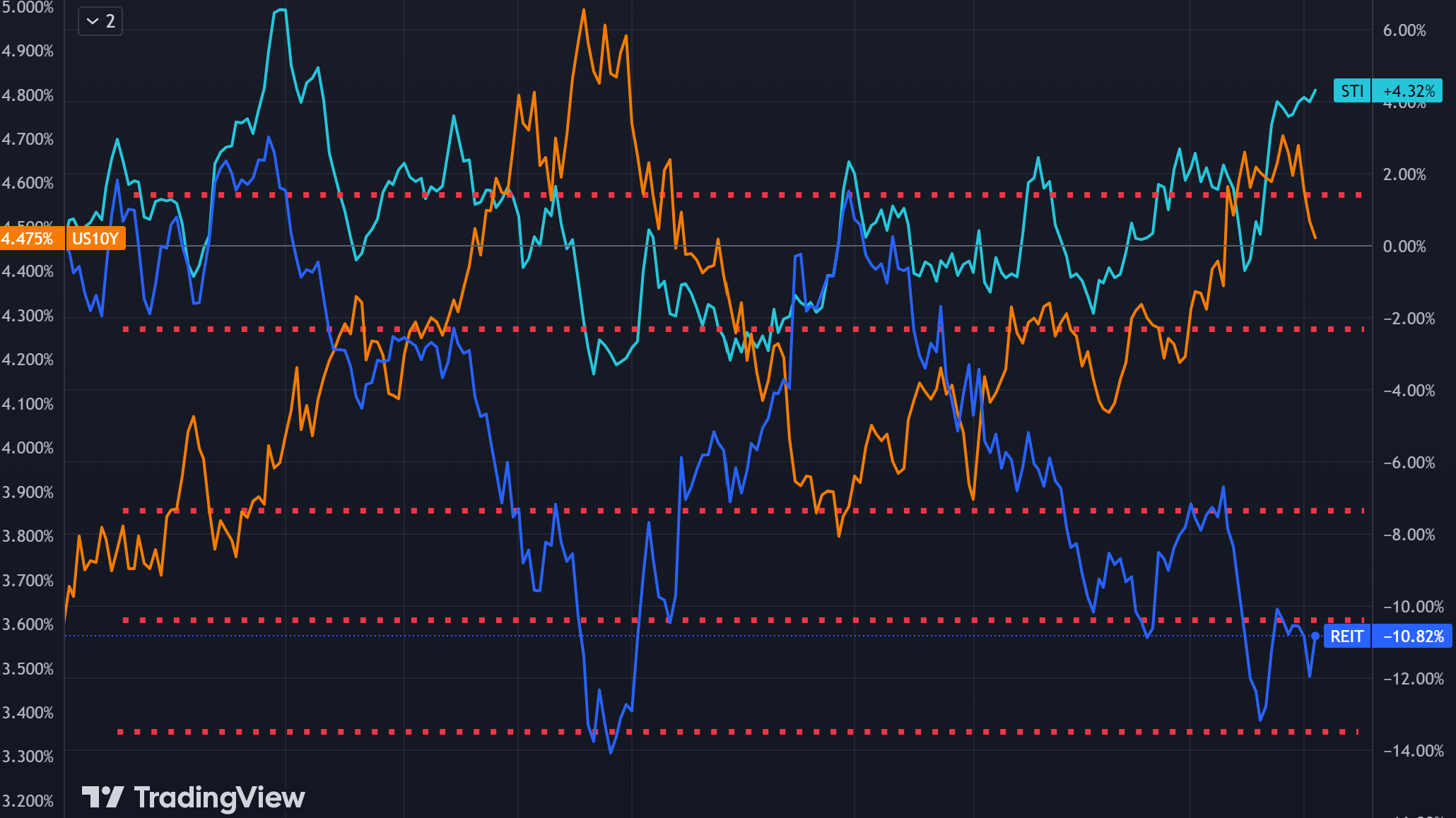

The chart above shows of the inverse correlation between the iEdge S-Reit Index (in blue) and the US 10-Year Treasury Bond Yield (in orange). The US 10-Year Treasury Bond Yield has dipped below 4.5% while the iEdge S-Reit Index is testing a resistance region.

So what caused the US 10-Year Treasury Bond Yield to ease while the iEdge S-Reit Index recovered? It is likely to be the bullish sentiment formed after the weaker than expected US Non-Farm Payrolls. Only 175K jobs were created instead of the expected 238K. The US Unemployment Rate also climbed to 3.9% instead of holding steady.

Now you may be thinking why did the SREITs sector recovered if the job situation in US has weaken. This is what I meant earlier by “randomness”. Basically investors are relieved that the data did not give the US Federal Reserve more reason to hold or increase interest rates and that this may be an early indication of inflation easing.

We are in a hostage situation whereby sentiment react to data, often in unexpected ways.

I sound like a broken record but I really cannot stress enough the importance of being selective with SREITs investments. Look for those demonstrating prudent cost management and active revitalization of their portfolios as key indicators of potential resilence. Such trusts usually suffer less during sell offs.

I have increased my weekly investment in the CSOP iEdge SREIT ETF. This strategy allows me to maintain exposure and diversification within the SREITs sector, while also reducing my overall investment cost through dollar-cost averaging. I find this approach particularly useful now, given the bearish sentiment, as selecting individual trusts may expose me to the risk of unexpected downside events.

I also sold 10000 units of Keppel DC Reit for a small profit. (Trade has not been updated in my portfolio as I await settlement.) This is to reduce my exposure to REITs as the sector continues to face challenges. On the chart above, you can see a manifestation of it with STI up 4.32% but SREITs is down 10.82%. The trend is your friend and right now I do not see any obvious signs of a turnaround.

Found this article useful? Share it and let us all have free coffee from dividends!