iEdge S-Reit Index Weekly Review 8 Dec 23

Hi all!

Singapore REITs continued to receive upside pressure for the week, with a number of them testing previous highs.

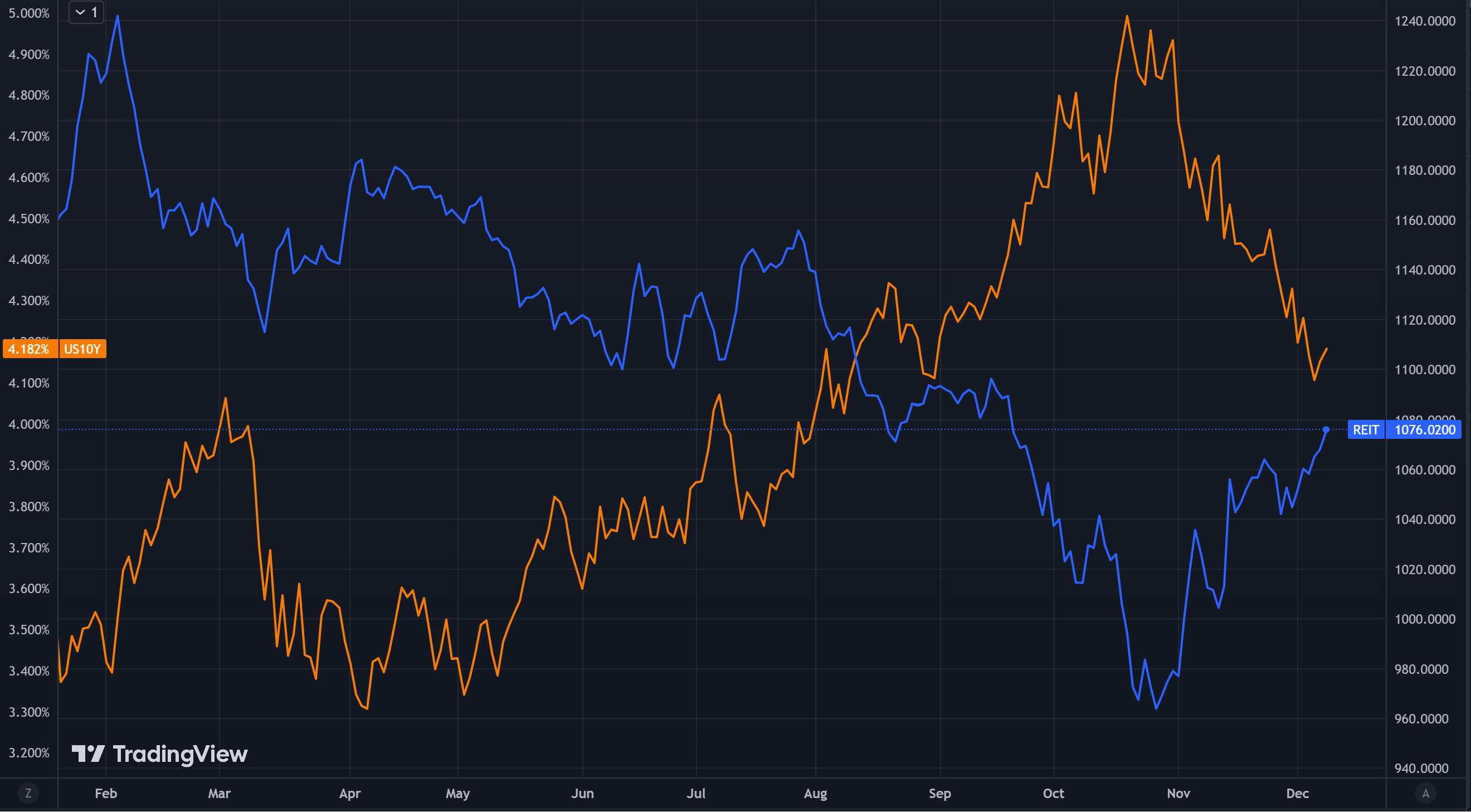

In the chart below, I plotted the US 10-Year Treasury Bond Yield against the iEdge S-Reit Index so that we can try to understand better what is happening. The iEdge S-Reit Index is regarded as Singapore’s S-REIT Benchmark and is a free-float market capitalization weighted index that measures the performance of real estate investment trusts in Singapore.

There appears to be an inverse co-relationship between the two. This means when the US 10-Year Treasury Bond Yield goes down, S-REITS generally go up.

This fits the narrative of a general market bet that the US Federal Reserve may be done with its interest rate hikes.

REITs are sensitive to interest rates because they often rely on borrowing to finance property acquisitions and developments. Higher interest rates mean higher borrowing costs, reducing profit margins. When interest rates rise, the cost of new loans or the refinancing of existing debt becomes more expensive, directly impacting their bottom line.

Furthermore, as REITs are popular for their dividend yields, increased interest rates make fixed-income investments like bonds more attractive as they offer higher yields with potentially lower risk. This can lead to a shift in investment from REITs to bonds, decreasing demand for REIT shares and potentially lowering their prices.

As long time readers will know, I prefer to be more conservative when it comes to risk. Hence I am not throwing everything I got, along with my Uncle Trousers into REITs. After all, no one knows for sure if the US Federal Reserve is really done with interest rate hikes for now.

Perhaps we can take a cue from the US Non-Farm payrolls due to be released today. It measures the change in the number of employed people during the previous month, excluding the farming industry. Job creation is an important leading indicator of consumer spending, which represents the majority of overall economic activity and strength. This may guide the US Federal Reserve actions.

A weaker than expected result may suggest that the interest rate hikes are working while a stronger than expected report may lead to the consideration of more tightening measures.

Enjoy your weekend and I’ll see you next week!

(BTW subscribe for updates la. See below :P)